does ca have estate tax

To calculate the amount of Estate Administration Tax the estate owes use the tax calculator. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

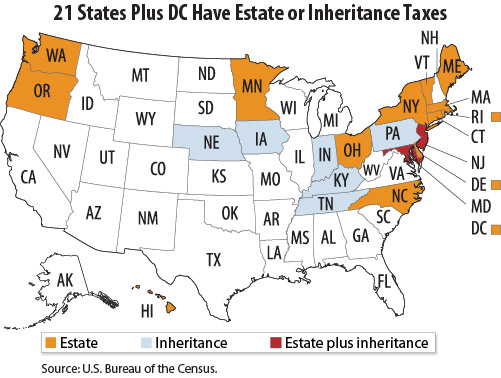

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

In California retirement accounts and pension plans are.

. The state of Wisconsin charges the transfer tax based on the sale price. Tax amount varies by county. The base tax rate is one of the.

Does California Have an Estate Tax. However California residents are subject to federal laws governing gifts during their lives and their estates after they die. However the federal gift tax does still apply to residents of California.

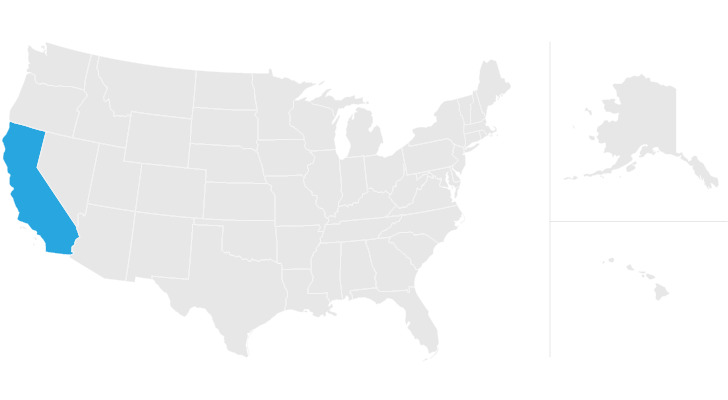

As long as the estate in question does not have assets exceeding 1170 million for 2021 or 1206 million. No California estate tax means you get to keep more of your inheritance. California does not have an inheritance tax estate tax or gift tax.

If you applied for an estate certificate before January 1 2020 the tax rates are. California does not levy a gift tax. We also offer a robust overall tax-planning service for high net-worth families.

The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the. We have offices throughout California and we offer in-person phone and Zoom appointments. For most individuals in California this is no.

California also does not have an inheritance tax. California does not impose an estate tax but the federal government does. Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country.

The Economic Growth and Tax Relief. And married couples or Registered Domestic Partners can save up to 500000 using the capital. There is an exception for estate tax and that can be a little confusing.

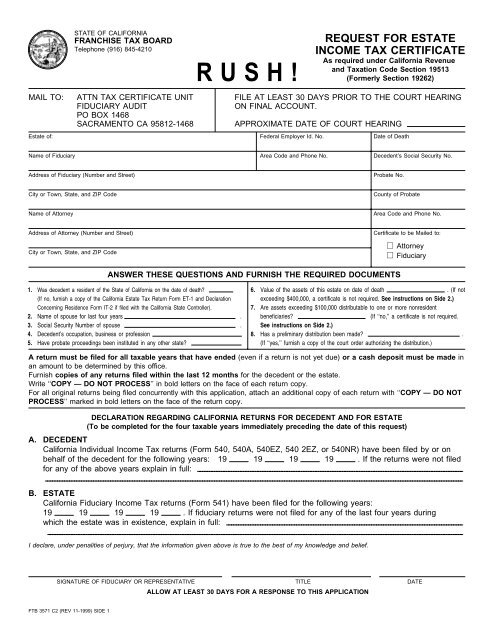

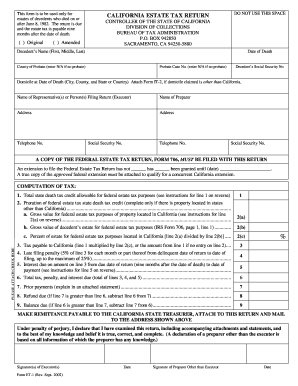

In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Notably only Maryland has both. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS.

California does not have a separate capital gains tax rate unlike some jurisdictions. They charge at a rate of 030 for every 100 or fraction thereof of the purchase price. What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance.

People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. California does not have its own estate tax nor does it have its own gift tax.

1999 Request For Estate Income Tax Certificate California

Seattle Tacoma Estate Tax Returns Federal Wa State Taxes

California Estate Planning Tax Cunninghamlegal

California Prop 19 Property Tax Changes Inheritance

State Estate And Inheritance Taxes Itep

California Estate Tax Everything You Need To Know Smartasset

California Guide To Tax Estate Financial Planning For The Elderly Lexisnexis Store

Estate Tax Reform Must Not Come At States Expense Center On Budget And Policy Priorities

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

Death And Taxes Nebraska S Inheritance Tax

Will My Heirs Be Forced To Pay An Inheritance Tax In California

California Estate And Gift Tax Planning Forms And Practice Manual

There Is No California Inheritance Tax Los Angeles Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

California Estate Tax Return Fill Online Printable Fillable Blank Pdffiller

Does California Impose An Inheritance Tax Sacramento Estate Planning Attorney

California Estate Planning Lawyer For Tax Concerns Los Angeles Estate Tax Protection Attorney